Aadhaar Card & Bank Link Online & Status Check – UIDAI Official

Aadhaar seeding or Aadhaar & Bank Linking means connecting your 12-digit Aadhaar number to your bank account. Think of it like creating a digital bridge between your identity proof (Aadhaar) and your money (bank account). This connection helps the government and banks manage finances more efficiently.

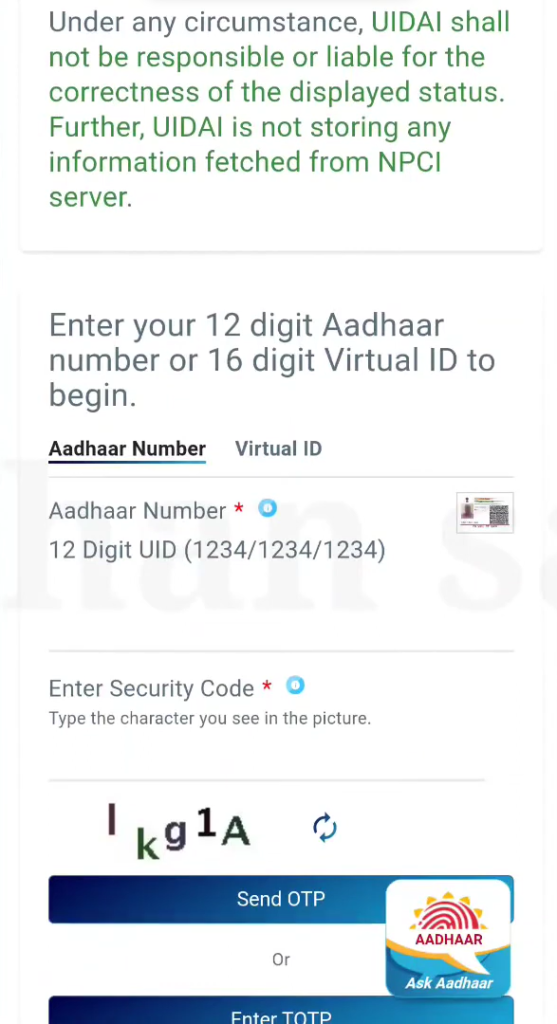

How to Check Aadhaar-Bank Linking Status

The easiest way to check if your Aadhaar is linked to your bank account is through the Official UIDAI website. Here’s what you need to do:

You may want to download E-Aadhaar copy Checkout: Aadhaar Card Download

Methods to Link Aadhaar with Bank Account

If you find your Aadhaar isn’t linked, don’t worry! You have several simple options to link it:

Online Methods

There are two primary methods that we use to Link Bank Account with Aadhaar Card Online which are given as follows:

Through Internet Banking:

Using Mobile Banking App:

Offline Methods

If you want to link your Aadhaar Card physically, you can follow any of the given method below:

Visit Bank Branch:

Through ATM:

You can check NPCI Aadhaar Bank Link Status in detail if you want to see in detail.

Important Documents Required

Before starting the linking process, keep these documents handy:

Benefits of Linking Aadhaar with Bank Account

While linking isn’t mandatory anymore, it offers several advantages:

Common Issues and Solutions

Sometimes you might face issues while linking. Here are solutions to common problems:

Special Cases and Exceptions

There may be special case or exceptions for linking your Aadhaar Card with your bank, each of them is given below:

1. Joint Accounts

For joint accounts, each account holder needs to link their Aadhaar separately. Visit your branch for specific guidelines on linking the bank account with 2 Aadhaar Cards.

2. NRI Accounts

NRI account holders have different requirements. You may consult your bank for special procedures applicable to NRI accounts as the requirements are different for different types of account.

3. Minor Accounts

For accounts of minors, parents Aadhaar can be linked. Once the minor turns 18, they need to update with their own Aadhaar.

Post-Linking Verification

After linking, always verify:

Security Measures and Privacy Concerns

Your privacy is protected when linking Aadhaar with your bank account. Banks use encrypted channels for data transmission. The linking process follows strict UIDAI guidelines to ensure your information remains secure. Regular audits are conducted to maintain data safety.

Benifits of Aadhaar-Bank Linking

The banking sector is moving towards complete digitization. Aadhaar linking will play a crucial role in:

Frequently Asked Questions

Q1: Is it mandatory to link Aadhaar with bank account?

No, it’s not mandatory. However, linking is required to receive government benefits and subsidies.

Q2: How long does it take to link Aadhaar with bank account?

Usually 24-72 hours, depending on the method used.

Q3: Can I link multiple bank accounts with one Aadhaar?

Yes, you can link multiple bank accounts with your Aadhaar number.

Q4: What if my Aadhaar linking status shows inactive?

Visit your bank branch with your Aadhaar card and request reactivation.

Q5: Do I need to carry original Aadhaar for offline linking?

Yes, carry both original and self-attested copy of your Aadhaar card.

Q6: Can I update my mobile number during linking?

Yes, but it’s better to update your mobile number in Aadhaar first.

Q7: What happens if linking fails multiple times?

Visit your bank branch with original documents for assisted linking.

Conclusion

Linking your Aadhaar with your bank account is a simple process that can be done through multiple convenient methods. While it’s not mandatory, the benefits make it worthwhile. Choose the method that works best for you and ensure you’re ready to receive all banking benefits seamlessly.